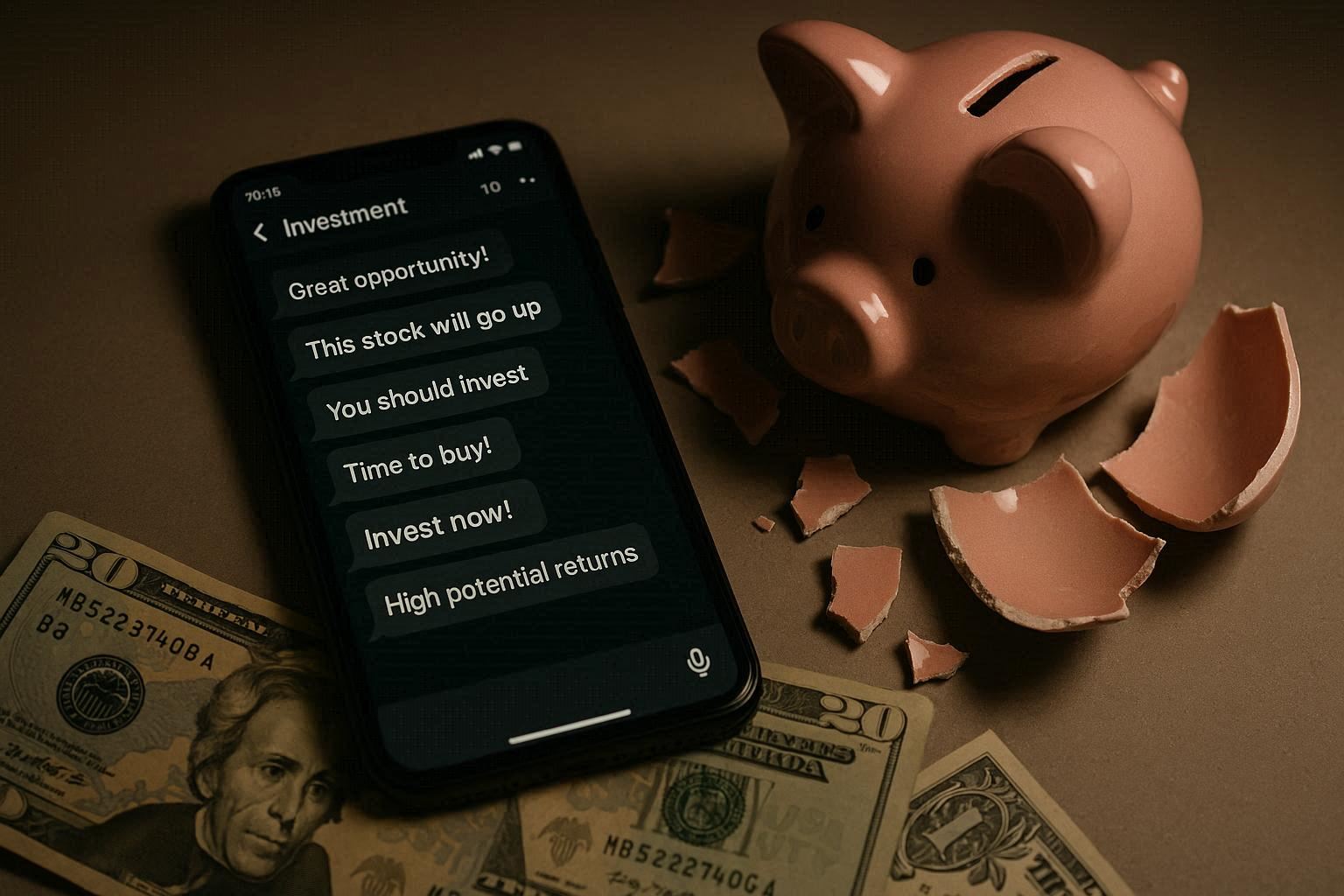

A devastating financial loss has highlighted how pervasive and convincing WhatsApp-based investment scams can be. One victim in India reportedly lost Rs 16 lakh after engaging with what appeared to be legitimate stock market investment advice sent via WhatsApp. The incident serves as a warning about the sophistication of modern scams, and the steps you can take to protect your money and personal information.

In this article, we break down how the scam worked, why it was so believable, and what you can do to stay safe.

How the WhatsApp Stock Scam Worked

According to the victim’s account, the scam began with a message on WhatsApp from a contact offering tips on high-yield stock investments. The messages contained:

-

Claims of insider or expert knowledge

-

Screenshots of stock gains and profits

-

Links to external platforms presented as trading interfaces

-

Pressure tactics to invest quickly

Because WhatsApp allows easy forwarding and group sharing, the scam message spread rapidly and looked authentic, even to someone experienced with digital communication.

What the Victim Experienced

The victim followed the instructions, which typically involve:

-

Clicking a link sent through WhatsApp

-

Registering on a third-party platform with personal details

-

Transferring funds via UPI, net banking, or mobile wallets

-

Seeing a balance purportedly “growing” in the platform’s interface

At first, the platform showed increasing returns, giving the user a false sense of progress and trust. But when the victim attempted to withdraw money — including the original investment — the platform blocked the transaction or provided inconsistent excuses, at which point the funds were effectively lost.

This pattern is common in investment scams: initial rewards and fake balances are used to lure victims deeper, then withdrawals are restricted or denied once large amounts are involved.

Why Scams Like This Are So Effective

Modern scams often succeed because they exploit:

-

Trust in contacts: Messages coming from WhatsApp make them feel personal and legitimate.

-

Lack of verification: Users assume shared links and screenshots are real without checking them.

-

Promise of easy profit: High returns with little risk are psychologically appealing.

-

Urgency and pressure: Scammers urge quick action to avoid “missing out.”

Scammers also use technology to make fake trading interfaces look real, including dashboards, balances, and transaction logs — all designed to deceive.

Red Flags to Watch For

Here are some common warning signs of investment scams on WhatsApp or messaging apps:

1. Unsolicited Financial Advice

Messages about opportunities you didn’t ask for should raise suspicion.

2. Guaranteed or Unrealistic Returns

No legitimate investment guarantees profit. Promises of quick riches are a red flag.

3. Links to Unverified Platforms

If the URL looks odd or the trading interface is unfamiliar, stop before entering any data.

4. Pressure to Act Fast

Scammers create urgency so you don’t take time to verify details.

5. Requests for Personal or Financial Info

Never share UPI PINs, banking passwords, OTPs, or Aadhar details with unverified contacts.

How To Stay Safe From WhatsApp Investment Scams

Protect yourself and your money with these practical steps:

Always Verify the Source

Even if a message is from a known contact, confirm directly through a call or separate message whether they actually sent the information.

Do Your Own Research

Look up the investment opportunity independently rather than relying on forwarded screenshots or messages.

Avoid Entering Sensitive Details

Never give banking credentials, OTPs, or PINs to any platform unless you are completely sure it’s legitimate and secure.

Use Official Platforms

For investments in stocks, mutual funds, or ETFs, use recognized apps and websites provided by registered brokers and financial institutions.

Report Suspected Scams

Report any fraudulent messages to WhatsApp and your local law enforcement. Many platforms also have mechanisms to report scam accounts and links.

Practical Takeaways

-

Don’t trust unsolicited financial advice on messaging apps.

-

Verify every investment source before transferring funds.

-

Keep personal and banking data private.

-

Use official, registered investment services only.

-

When in doubt, seek professional financial advice.

Scams can happen to anyone, but informed decisions and healthy skepticism can dramatically reduce your risk.